Finance Utilities

Cash and bank management setup - Bank reconciliation matching rules

Cash and bank management setup - Bank reconciliation matching rules

The fields as described in the following subsections are available to control the additional functionality for advanced bank reconciliation.

User can select an existing rule, select Copy matching rule on the Action Pane to create a copy of the existing rule. User can then edit the new rule and activate.

Finance utilities functionality extends the automatic reconciliation matching rules by adding Group by document number to Reconciliation matching rules with Action Match with bank statement in ‘Step 1: Define the matching rule’.

Note: From 10.0.32 MS has added a feature called Ability to post detailed vendor and customer payments, but summarize amounts to bank account.

- If this feature is enabled and setup to summarise, journals that contain multiple lines that matches the criteria will be grouped into one bank transaction line.

- The new ‘Bank transaction summarization id’ is written to the Bank reconciliation’s Document number for the Bank transaction.

- This will affect companies that use Financial utilities parameter Populate bank transaction document number and Group by document number functionality on Reconciliation matching rules as the Payment journal’s ‘Journal batch number’ isn’t written to the Bank reconciliation’s Document number (if the journal contains multiple lines that matches the criteria).

The Finance utilities feature can be activated from Cash and bank management > Setup > Advanced bank reconciliation setup > Reconciliation matching rules

| Field | Description |

|---|---|

| Group by document number | This feature combines the D365 bank transactions amount that have the same Document number (populated with the Journal id or check number) during the Bank reconciliation process, from Run matching rules. |

If the Financial utilities parameter’s Extended matching rule operator is set to Yes, the option Included in is available for selection in ‘Step 1: Define the matching rule’.

When the Operator Included in is selected, D365 checks whether the value of Field is included in the value of the Statement fields.

Included in example:

| Basic Criteria | Yes or No |

|---|---|

| Match Amount | Yes |

| Match Date | Yes |

| Match Document Number | No |

| Match Transaction Type | No |

| Match Payment Reference | No |

| Field | Operator | Included in | Value | Statement Fields |

|---|---|---|---|---|

| Payment reference | Contains | Tick | Document number |

| Source | Matched | Booking Date | Debit | Credit | Bank Trx Type | Document number |

|---|---|---|---|---|---|---|

| D365 Bank Trx | ||||||

| Line 1 | X | 14/01/2018 | 1000 | 01 | AAU1367611 | |

| Line 2 | 14/01/2018 | 1000 | 01 | AAU1367612 | ||

| Bank Statement Trx | ||||||

| Line 1 | X | 14/01/2018 | 1000 | 699 | CBA pmt AAU1367611 | |

| Line 2 | 14/01/2018 | 1000 | 699 | CBA pmt AAU1367613 |

In this example, when the above Reconciliation Matching rule is run, D365 Bank Transactions Line 1 will be matched with Bank Statement Transactions Line 1 because the Document number value “AAU1367611” is included in the value of the field Reference No “CBA pmt AAU1367611”.

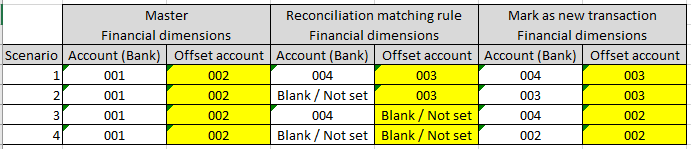

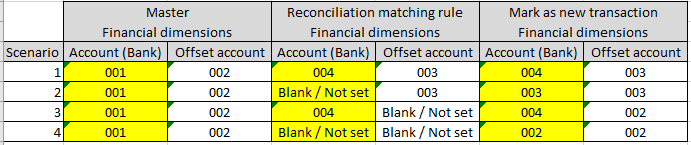

If the Financial utilities parameter’s Extended financial details for new transaction parameter is set to Yes, the option to capture the following details automatically for Mark as new bank statement lines can be selected.

More detail for ** fields are discussed here.

| Field / Button | Description |

|---|---|

| Financial Dimensions > Offset account | Financial dimensions that have to be used to post the new transactions. If the dimensions are filled in, it will override the financial dimensions set by default on the selected Offset account (Ledger, Customer, Vendor or Bank). Else, financial dimensions set by default on the selected main account will apply with the new transaction.  |

| Financial Dimensions > Account | Financial dimensions that have to be used to post the new transactions. If the dimensions are filled in, it will override the financial dimensions set by default on the selected Account (Bank). Else, financial dimensions set by default on the selected main account will apply with the new transaction.  |

| Offset Company Account | Defaults to the current legal entity. Populates the new field Offset Company Account in the Bank Statement Line Details form when a Mark as new line is created. |

| Offset Account type | Populates the new field Offset Account Type in the Bank Statement Line Details form when a Mark as new line is created. Note: This field defaults to Ledger; Extended financial details only support offset account type Ledger, Customer and Vendor. |

| Offset Account | Populates the new field Offset Account in the Bank Statement Line Details form when a Mark as new line is created. |

| Offset account bank statement field ** | Enabled when Offset account type is set to Customer. Option to map a field from the bank statement for Offset account. Offset account and Offset account reference bank statement field needs to be blank, will receive error if try to populate multiple fields when setting up a rule. |

| Offset account reference bank statement field ** | Enabled when Offset account type is set to Customer. Option to map a field from the bank statement for finding the D365 customer account using Customer references Ensure Reference type has been populated in Financial utilities parameters. Offset account and Offset account bank statement field needs to be blank, will receive error if try to populate multiple fields when setting up a rule. |

| Settle transaction ** | Enabled when Offset account type is set to Customer. When creating the customer payment journal for the customer, should it attempt to settle the invoice. |

| Settle transaction bank statement field ** | Enabled when Offset account type is set to Customer. Option to map a field from the bank statement for the transaction (D365 invoice) to be settled in the Customer receipt journal line. If Offset account, Offset account bank statement field and Offset account reference bank statement field are blank, this field will be used to find the D365 customer account to create the Customer payment journal line. |

| Auto-post customer payment journal ** | Enabled when Offset account type is set to Customer. Indicates if the created (and settled if applicable) customer receipt journal should automatically be posted. If automatically posted, the newly created bank transaction(s) will also automatically be matched to the applicable bank statement lines. |

| Auto-post and transfer customer payment journal ** | Enabled when Offset account type is set to Customer. Indicates if the created (and settled if applicable) customer receipt journal should automatically be posted. If any errors found (example stopped customer), the error lines will be moved to a new journal. Both customer payment journals’ Document will refer to the Bank reconciliation. If automatically posted, the newly created bank transaction(s) will also automatically be matched to the applicable bank statement lines. |

| GST Group | Populates the field GST group in the Bank Statement Line Details form when a Mark as new line is created. |

| Item GST Group | Populates the field Item GST group in the Bank Statement Line Details form when a Mark as new line is created |

| Description mask | Ability to set a Description mask for Mark new transactions. Editor provides the ability to set a combination of static fields and placeholders: • Currency • Description • Amount • Document number • Entry reference • Bank statement transaction code • Reference No. • Related bank account • Name (Trading party) • Bank account • Bank account number • Bank groups Note: If File name mask is not populated, the Bank statement line’s Description will be written to new transaction’s Description. |

This section will provide more details for ** fields from above section. Finance utilities allows for creating and optional settling of one invoice and optional posting of customer payment journal. One customer payment journal is created for all the bank statement lines matched with the mark as new rule. For improved traceability the Reconcile ID is populated in the Customer receipt’s journal Document on the journal’s setup tab. The customer payment journal’s Date is set by the bank statement’s Booking date.

The following subsection will discuss scenarios when running a Mark as new rule with Offset account type set to Customer

The ability to set field format is available for the following fields:

Select the Field format for the applicable field and set one of the following options:

The Example and Value field is automatically updated based on above selection. The user can also paste/type their own example into Example to view the resulted Value from their setup.

Example result for each option:

| Option | Setup | Example Bank statement field’s original data |

Value |

|---|---|---|---|

| No format | xxUS-001xx | xxUS-001xx | |

| Fixed field position | Start position: 2 Length: 6 |

xxUS-001xx | US-001 |

| Delimited field position | Delimiter: Field position: 0 |

US-001 extra description | US-001 |

| Custom format | \*(.+)\* |

*US-001* | US-001 |

Additional setup is also required on Financial utilities parameters to assign the following:

If Financial utilities parameter Populate unique voucher for each journal line is set to No, it is also required to configure General ledger parameters. When the system creates a customer payment journal for the bank statement transaction, the one voucher could contain lines for multiple customers. Therefore, you must set up your system so that a single voucher can have multiple customer lines.

To enable a single voucher to have multiple customer lines, follow these steps.

Bank reconciliation

When the rule is run, a customer payment journal is created and the Journal id will be provided in the Message details

Customer payment journal

The following fields are populated in the created customer payment journal: